PCG Insights: Flattening the PE J-Curve

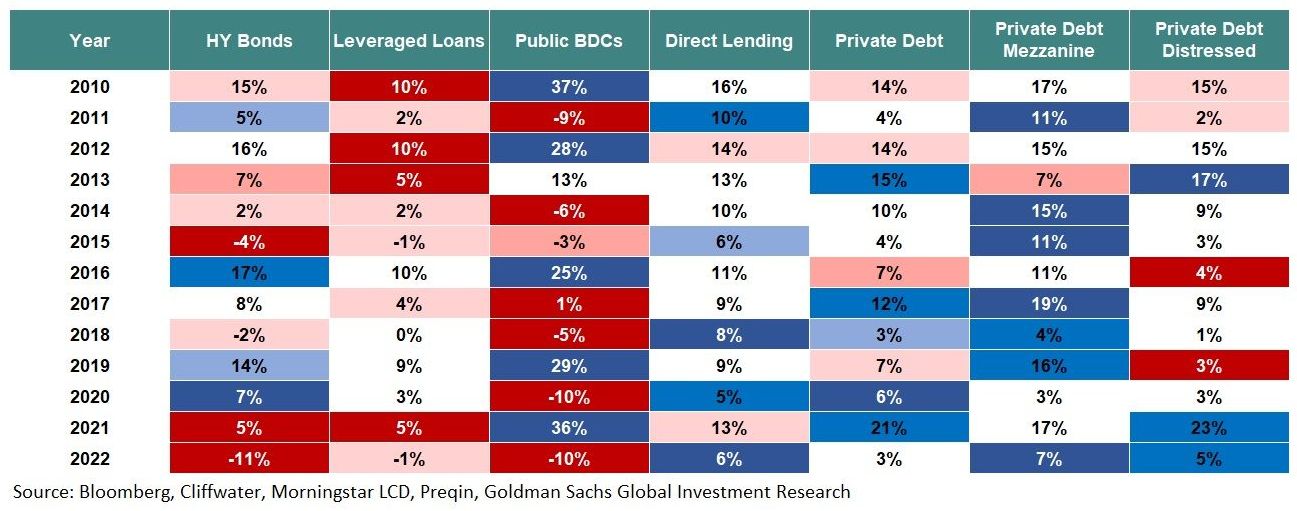

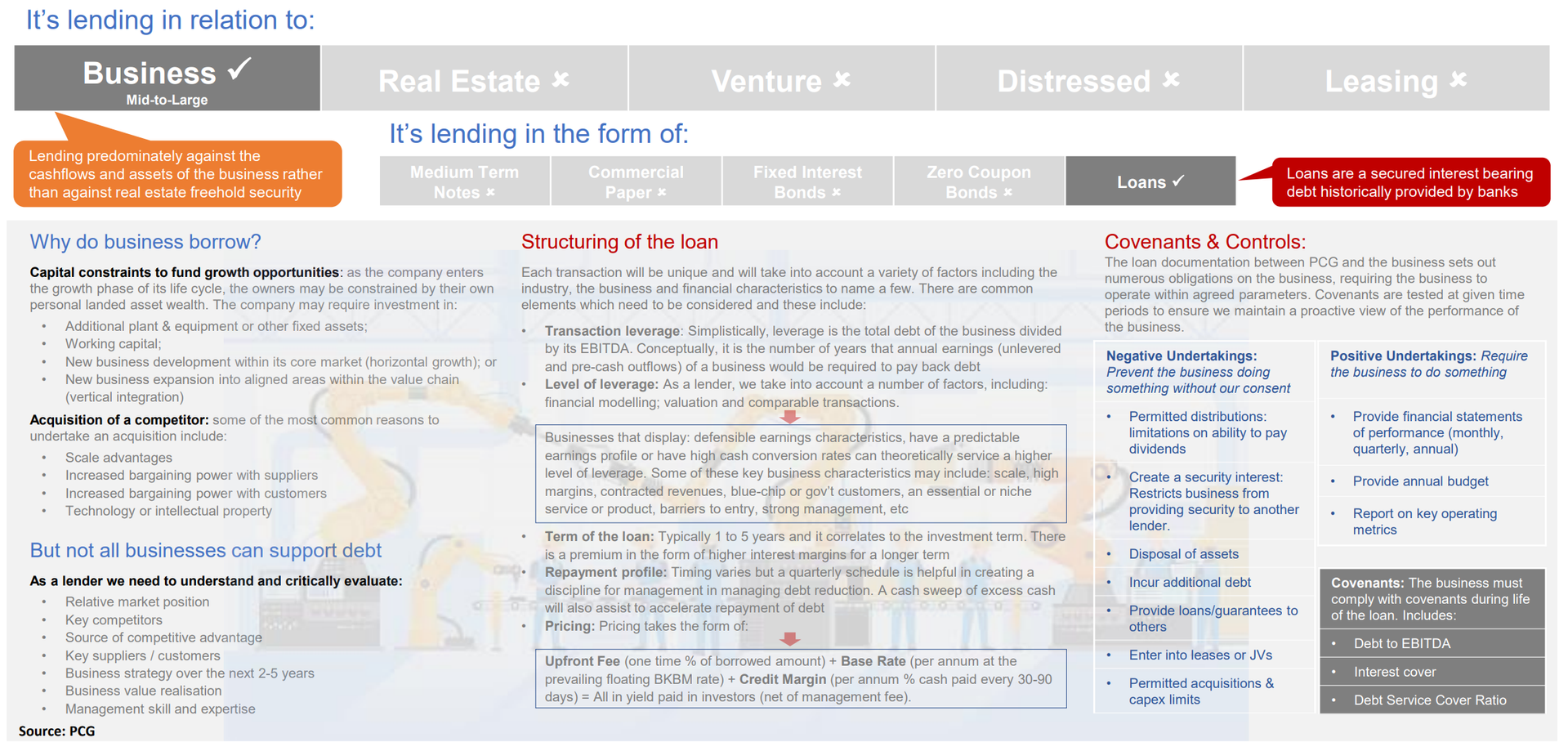

As part of a flexible approach to cash management from investments, investors should consider a tactical allocation to Private Debt within an Alternatives portfolio.

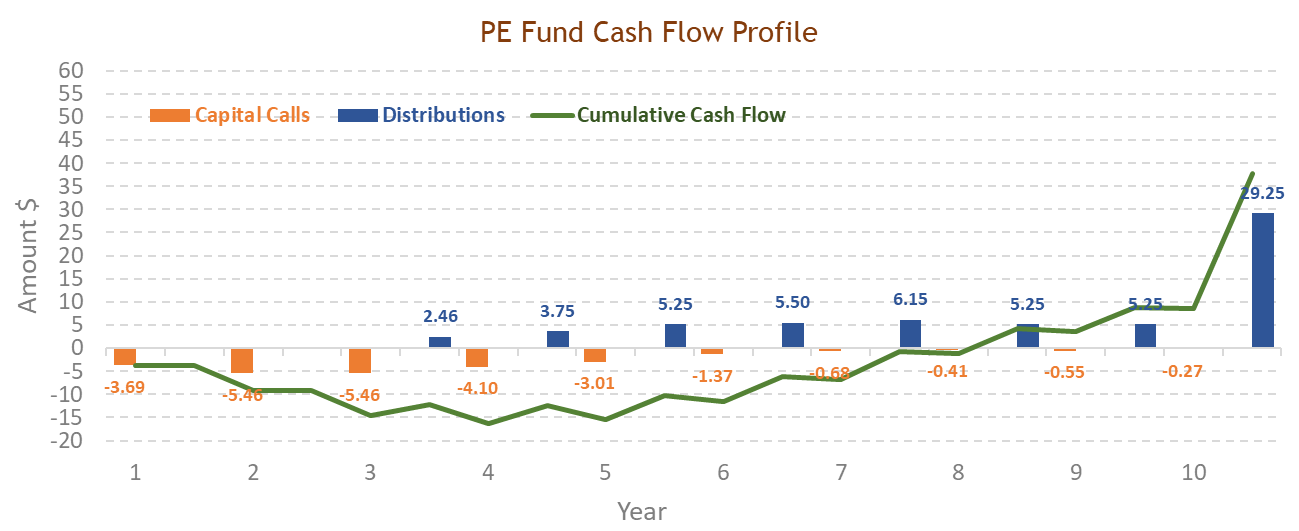

Combined with an existing allocation to Private Equity, the consistent income generated from Private Debt can flatten the ‘J-Curve’ effect associated with Private Equity.

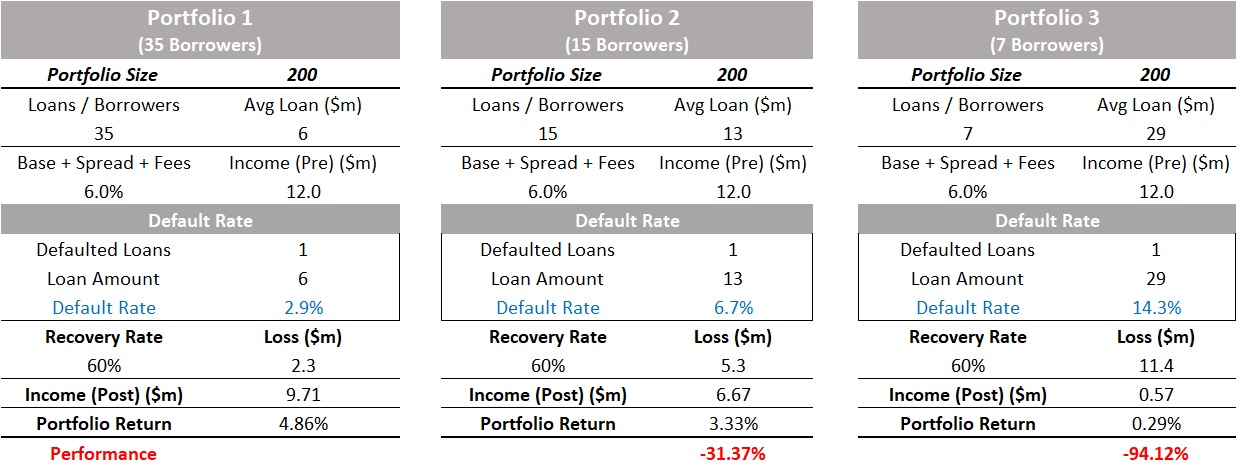

The lower return volatility from the contractual and linear nature of cashflows, enables investors to help meet their commitments to beneficiaries (social, impact, institutional), through an allocation to Private Debt. In the following example portfolio, a $50m Alternatives portfolio is split equally between Private Equity (PE) and Private Debt (PD). For simplicity, we assume: a) consistent drawdowns from the GP; b) exits split evenly across the years and; c) re-investment of individual loan assets at the same initial margin.

The PE allocation typically generates a higher return over time but LPs are faced with the associated challenge of managing the timing mis-match between cash outflows to meet capital calls and the receipt of cash from distributions.

In contrast, the PD allocation is immediately cash flow positive. While returns are typically lower relative to PE, it provides a regular and predictable income and cash flow stream with highly attractive risk-adjusted returns.

*Note: the capital investment has been excluded from the cash flow profile to isolate the distribution stream

The combination provides favourable capital gains from PE, which builds capital, and a low variance distribution based cashflow, from PD, which helps investors meet their own liability and distribution needs.